News

Sri Lankan insurance industry yet to realise full potential

The insurance industry in Sri Lanka is still at early stage of the lifecycle despite the growth momentum in recent times. Despite low penetration, total insurance premium income over the last five years has witnessed higher growth relative to GDP growth of the country with total industry assets growing at a 14% CAGR annually.

The industry can be segregated into Life insurance and General (non-life) Insurance, where we see life insurance to lead general insurance in terms of Gross Written Premium (GWP) growth.Today, the country has a Rs. 498 billion insurance industry in terms of total assets splitting Rs. 332 billion and Rs. 166 between Life and General insurance respectively. Twelve insurers solely operate in Life insurance business along with another three composite insurers handling both General and Life; 13 companies operate as General insurers.

Low insurance penetration along with GDP per capita rise and demographic changes to drive Life insurance growth

The Sri Lankan Life insurance sector has been growing steadily with a total asset average annual growth of 17% since 2009. But Sri Lanka being a country largely characterised by the collectivism and dependency where the need for a Life insurance policy is yet to be realised, industry still remains to be a small sub sector accounting less than 3% of total financial sector assets by 2015.

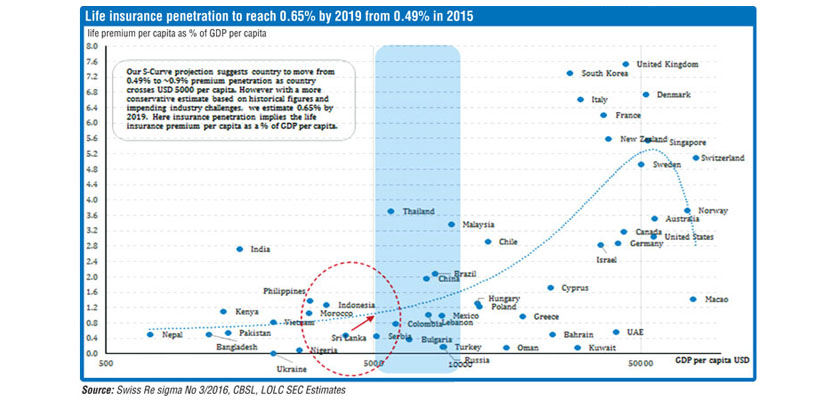

Accordingly, the industry is heavily under-penetrated compared to regional peers who have comparable GDP per capita (Vietnam, Indonesia and Philippines) giving a strong impetus for a steady growth along with GDP per capita rise (level of income growth) while industry becoming attractive for companies due to low competition.

Although low per capita income which is common for a developing country like Sri Lanka and higher cost of living have historically been deterrent factors in obtaining Life insurance policies, its present direction of achieving upper middle income status by 2018 is likely to provide a convenient platform for more people to spend on life policies. We estimate the country to record moderate 5.3% real GDP growth over the next three years and resulting GDP per capita to achieve $ 5,200 by 2019. Accordingly, with greater spending power and excess income, industry penetration is expected to be improved benefiting Life insurers.

As per the projected S-Curve, Sri Lanka’s Life insurance industry is poised for a steep growth after $ 5,000. Based on the S-curve and GDP per capita estimates, we forecast a moderate penetration of 0.65% by 2019 and thus recording 21% GWP growth annually for the next three years as opposed to 11% growth historically. Twenty-one per cent growth is a derivation from estimated GDP per capita growth, estimated population growth, premium added on higher industry growth over per capita GDP growth and demographic changes such as higher urbanisation, increasing ageing population and Non-Communicable Diseases (NCDs).

With 0.65% penetration, we forecast industry GWP to be Rs. 115 billion by 2019 compared to Rs. 54 billion in 2015. In a medium to long run target (five-15 years) of $ 5,000-10,000, we expect the industry to record a steeper growth with penetration level increasing from 0.65% to 1.6% as country will then be into high middle income countries’ (such as Thailand and Malaysia) income level bracket and thus emanating similar level of penetration. However, at high income level ($ 15,000), the industry operates in a manner that the income elasticity of demand for Life insurance reaches maximum, resulting in flat industry growth.

We believe that Sri Lanka’s Generation Y (born in 1980-2000) is more interested in risk-based insurance products compared to Gen. X as Gen. Y seeks more financial security and stability for their families due to complexities in their lifestyle. Furthermore, Gen. Y will find it difficult to accumulate wealth to finance emerging needs, especially with decreasing real interest rates.

Statistics also suggest that the industry is heading north with new Life polices recording 5% annual growth since 2010 (at a faster phase than population growth of 0.9% due to low penetration). To support this growth, distribution channels have also seen a strong average annual growth of 17% over the last five years. Thus we believe that the industry is positioned in a clear growth trajectory benefiting insurers to record higher profitability.

Non-Life (General) insurance to lag behind

The Sri Lankan Non-Life insurance sector has been growing steadily with a total asset annual growth of 9.43% since 2011. In a local context, this sector is mainly classified under motor, health, fire, marine and other where 62% of sector premium is accounted by motor insurance premiums.

Motor insurance is a mandatory requirement and every registered vehicle owner is required to have a minimum third party motor insurance if they wish to use a motor vehicle on the road. But as a whole, Non-Life insurance penetration remains relatively low compared to regional peers due to intense price competition and slow growth of respective insured segments of the country hindering the expansion of General insurance business compared to Life insurance. In fact, out of total motor insurance policies issued, majority is dominated with the third party insurance (54% of total motor insurance premium in 2015) reflecting that people tend to look for a minimum level of protection with minimum possible premium due to legal requirement instead of buying it as a risk-based product.

Motor insurance premium contribution to be limited

The local motor insurance sector is currently facing an intense price competition while existing players undercut prices to increase their market share as there is lower “switching cost” for the policyholders. Additionally, there is no “floor price” imposed by the regulator for motor premiums to control premium charges. As the new registration of motor vehicles and vehicle population of the country are highly dependent on the vehicle leases and hire purchases, prevailing tight monetary conditions are expected to result in slow down of vehicle financing limiting the growth in motor sector. Thus we expect motor premium CAGR to slow down to 7% for the next three years as opposed to 12% historically and motor premium contribution to Non-Life GWP to be limited to 58% in line with limited growth in motor sector and considering the price competition in the motor insurance sector.

Further, Sri Lankan motor insurers experience a higher combined ratio of more than 100% (net expense and net claims ratio) relative to regional peers due to high cost of motor claims relative to lower motor GWP income. Accordingly, higher combined ratios put pressure on the financial performance of Non-life companies resulting in weakening profitability for most of the Non-Life insurers.

Health premium contribution to GWP to increase with rising health spend

Sri Lanka’s health spend per capita has seen a rapid growth of 11% CAGR during the last decade and is expected to continue the same growth phase. Accordingly, we expect health contribution Non-Life GWP to increase in line with the expected rise in health spend per capita and health contribution to Non-Life GWP to reach 16% by 2019 with a CAGR of 17% over the next three years.

Fire premium contribution to Non-Life GWP to remain at 9%

In line with rise of apartments and residential units we expect fire insurance contribution to GWP to remain at 9% by 2019F with a CAGR of 6% as opposed to 5% historically.

Marine contribution to Non-Life GWP to remain at 3%

We expect marine GWP to continue its growth at 5% CAGR amidst moderate growth expected in the world trade.

Based on projected S-Curve, Non-Life penetration is expected to move from 0.66% to ~1.2% as the country crosses $ 5,000 per capita. However, with impending challenges mainly related to motor industry, GWP growth is expected to lag behind with 0.55% penetration by 2019 thus recording 9% GWP GAGR for the next three years as similar to 10% growth historically. Combining with 0.65% Life insurance penetration, insurance industry in total will reach to 1.20% with total GWP estimated to be c. Rs. 210 billion by 2019. We expect Life GWP for 2019 to reach 56% vs. 46% in 2015 thus accelerating towards the world’s standard of Life exceeding Non-Life premium aggregate.

As opposed to world standards the Sri Lankan Non-Life sector led by the motor industry is highly dependent on investment income for bottom line growth rather than making profits from underwriting which is the core business of the insurance. However, we believe that this business model as not sustainable in the going forward.

Recent regulatory changes made by IBSL will be positive

The Government’s direction on regulating the industry was prominent in recent times with the introduction of Insurance Industry Act No. 43 of 2000 which led the creation of the Insurance Board of Sri Lanka as the regulator and supervisory body of the insurance industry. Landmark changes were introduced to the industry in 2011 with the passing of the amendment to the ‘Regulation of Insurance Industry Act No.3 of 2011’. Accordingly, most of the composite insurers were segregated to separate Life and General insurance companies and became listed.

Insurance companies with exceptions given to some were requested to be listed on CSE by February 2016 with a three-year grace period given to newly formed companies, consequent to the segregation. Accordingly, 10 insurers are currently being listed in CSE and three more are to be listed. In our view, listing will bring better transparency and good governance to the industry, as companies would be under the purview of the SEC.

The segregation has led to transform the industry with a more focus on the performance of individual entities, but with differing effects on companies, depending on the size and type of operation. Especially small and medium companies with significant exposure to General insurance have found this challenging as they can no longer depend on earnings of Life business to keep Non-Life business, which generally has low profit margins, afloat. Larger players instead have considered the change positively as it creates an opportunity to pay strong focus on each entity separately. Such industry dynamics have been leading for a gradual consolidation of the industry where it witnessed a series of disposals of parent company being sold off their Non-Life business.

With industry consolidation, a few large players have been leading both Life and Non-Life businesses with a strong cumulative market share. Thus we expect that small companies to fight hard for survival and to be subjected to take-overs by large players. However mid-tier companies like Softlogic Life, Union Assurance and HNB Assurance have been aggressive in their business which have enabled them to improve their market share at the expense of large insurers.

Further, IBSL has introduced the Risk Based Capital (RBC) rule replacing the previous Solvency Margin Rule and Rs. 500 million minimum capital requirement instead of Rs. 100 million. Most of Asian countries have complied with risk based solvency regime and this move will essentially align local industry with international standards. This will force companies to be more financially secured and compels them to be more liquid on settling liabilities. However, the minimum capital level of Rs. 100 million which translates to ~$ 3.33 million remains relatively below Asian countries.

Whilst investment income plays a major role in insurers’ profitability, thresholds implemented by IBSL on investment allocations of insurance funds will also helped companies to prudently manage investment and liquidity risk while effectively covering short and long term liabilities of policy holders. Financial assets of the insurance industry are mainly invested in three forms: Government securities, listed equities and corporate debentures where minimum 30% of Life funds and minimum 20% of General funds have to be invested in risk-free Government securities. Additionally, equity allocation has been given more prominence in Non-Life fund compared to Life funds to generate higher returns.

Higher industry valuations and Mergers & Acquisitions (M&A) multiples

Despite low Colombo Stock Exchange (CSE) multiples, the Sri Lankan insurance industry is trading at a Price-to-Book (PBV) of 1.77X times which is above the regional average of 1.65X times, reflecting its high growth potential. Recent M&A transactions carried out in local insurance space have also priced at higher PBV multiples which is a testimony that how parties involved for such transactions mostly foreign parties foresee the industry growth. For example, Softlogic Life (earlier Asian Alliance) recently divested its 100% Non-Life business to Fairfax Asia at 1.7 times of PBV and AIA acquired Life and Non-Life businesses from AVIVA NBD in 2012 at 3.7X PBV.

Latest insurance industry prospects through micro insurance, bancassurance and telecom industry

Micro insurance is an insurance product that offers coverage to low income households. Despite low poverty level compared to regional countries, still 6.7% of population is living on less than $ 2/day. The Samurdhi Authority in Sri Lanka is involved in micro insurance while number of registered micro insurance policies have increased from 0.35 m in 2012 to 1.4 m in 2015. Although the rural population is covered with Samurdhi scheme, low to middle segment is not covered by Samurdhi, indicating a strong growth potential in this sector which the private sector can tap into.

The insurance industry is running on an agent model where over the last five years, more than 90% of Life insurance GWP was generated by such agents reflecting their dominance in the industry. Thus, insurers have incurred substantial expenses as acquisition costs (agent commissions) and training and development to reduce high agent turnover rates (avg. 50%-60%). However, to mitigate the dependency on them, direct marketing and bancassurance are currently being given more prominence. But bancassurance is yet underutilised compared to other regions of the world despite a strong banking sector. Sri Lankan commercial bank branch density (18 branches per 100,000 people) is much greater than its peers and therefore insurers can conveniently utilise the same to boost premiums and reduce acquisition costs.

Insurers find it challenging to offer their products for low and middle income segments using traditional channels due to high administration cost. But with the development in IT and mobile technology backed by high mobile phone penetration (107%), industry could conveniently reach to more and new customers. Thus insurers increasingly partner with mobile network operators to use their platforms to approach a large pool of mobile phone subscribers.

Summary

We project Life insurance to show strong GWP compounded annual growth rate of 21% for the next three years, mainly due to three factors. Life insurance is significantly underpenetrated compared to peer countries giving strong upside potential, Sri Lanka’s demographical factors provide significant impetus for the growth of Life insurance and country’s stage of economic growth gives strong empirical case for rapid growth of Life insurance.

Comparatively General insurance has lesser upside as it has already been fairly penetrated with regulatory driven motor insurance (motor insurance accounts to 62% of non-life GWP) and there is significant price competition in the industry with 16 players striving for market share. Furthermore, the growth of motor insurance can be cyclically correlated with the cyclical motor industry. Compared to motor industry we see stronger potential in health insurance whilst the other main segment of General insurance, marine and fire insurance, are expected to continue with moderate growth.

The insurance industry’s potential bodes well for insurance companies, which is also reflected by higher PBV multiples compared to region, despite the CSE trading at lower multiples. We believe the insurance industry’s potential has yet not fully priced in and there are strong investment cases in the insurance sector. It is also reflected in higher pricing in Mergers & Acquisitions (M&A) space. The insurance industry has generally been active in M&A with a few transactions taking place in recent times.

The Life industry in particular has strong bottom line potential with GWP growth as well as favourable tax implications. Non-Life industry potential mainly lies on investment return potential with GWP being squeezed by high combined ratios.

http://www.ft.lk/article/604698/Sri-Lankan-insurance-industry-yet-to-realise-full-potential

Recent Posts

- LOLC Group achieves first-ever historic profitability in Sri Lanka’s corporate sector, recording a stunning Rs. 57 Bn in PBT

- LOLC dethrones JKH to become most profitable listed corporate

- Sri Lankan insurance industry yet to realise full potential

- LOLC buys majority stake in Cambodian microfinance firm